Layer 1s to Rule Them All: Stablecoin based L-1s Conquer Fintech

What is the end game for stablecoin based layer 1s?

Meme depicting Tether, Stripe and Circle launching their versions of L-1

Introduction

In less than 12 years, stablecoins have grown from a niche crypto experiment into a $280 billion + asset class and growth is accelerating as of Sept 2025. It is worth noting that their rise is fuelled not only by demand but by regulatory clarity with the recent passing of the GENIUS Act in the US and MiCA in the EU. Stablecoins are now firmly recognised by key Western governments as legitimate building blocks for the future of finance. Funnily enough, stablecoin issuers aren't just “stable”, they're highly profitable. Driven by a high interest rate environment in the US, Circle, issuer of USDC, reported $658 million in Q2 2025 revenue, driven largely by interest on reserves. It turned profitable in 2023 with $271 million in net income.

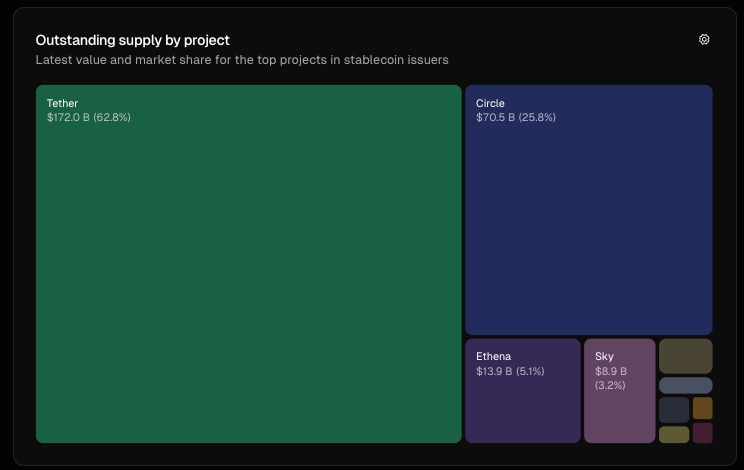

Source: tokenterminal.com, Outstanding supply on current stablecoin

This profitability has naturally invited competition. From Ethena’s algorithmic USDe to Sky’s USDS, challengers are emerging to break the dominance of Circle and Tether. As the battleground shifts, leading issuers like Circle and Tether are pivoting to build their own Layer 1 (L-1) blockchains, aiming to control the financial rails of the future. These financial rails are designed to deepen their moats, capture more fees and potentially reshape how programmable money moves across the Internet.

The trillion dollar question is: Can giants like Circle and Tether hold their ground against disruptors like Tempo (non-stablecoin native entrant)?

Why Layer 1s? Establishing context and differentiators

At its core, a L-1 blockchain is the base protocol that powers an ecosystem, from handling transaction processing, settlement, consensus and security. For my tech folks, think of it as the operating system (OS) of crypto (e.g; Ethereum or Solana), on top of which everything else is built.

For stablecoin issuers, moving into L-1 is about vertical integration. Instead of relying on third-party chains (Ethereum, Solana, Tron) or L-2, they are aggressively building their own rails to capture more value, tighten control and align with regulation.

To understand this race for control, let’s look at how Circle, Tether and Stripe’s L-1s share common features while carving distinct paths. The similarities across these issuers are as follows:

The use of their respective stablecoin as the native currency eliminates the need to hold ETH or SOL for gas fees. For instance, fees will be paid in USDC for Circle’s Arc or in other cases such as Plasma, fees are waived entirely.

High throughput, fast settlement: each of these Layer 1 promises sub-second finality with transactions per second (TPS) in the thousands (from Plasma’s 1k+ to Stripe’s Tempo 100k+).

Opt-in privacy and regulated environments: these are curated crypto ecosystems with stronger privacy and compliance although it comes at the cost of centralisation.

EVM compatible ensuring builders are familiar with the development standards.

Key differences:

Circle’s Arc is designed for both retail and institutional adoption. Its in-house FX engine (Malachite) makes it attractive for capital market transactions and payments, potentially positioning Arc as the “Wall Street” preferred rail of crypto.

Tether’s Stable and Plasma focuses on accessibility, offering zero gas fees, making transactions frictionless for retail and P2P users.

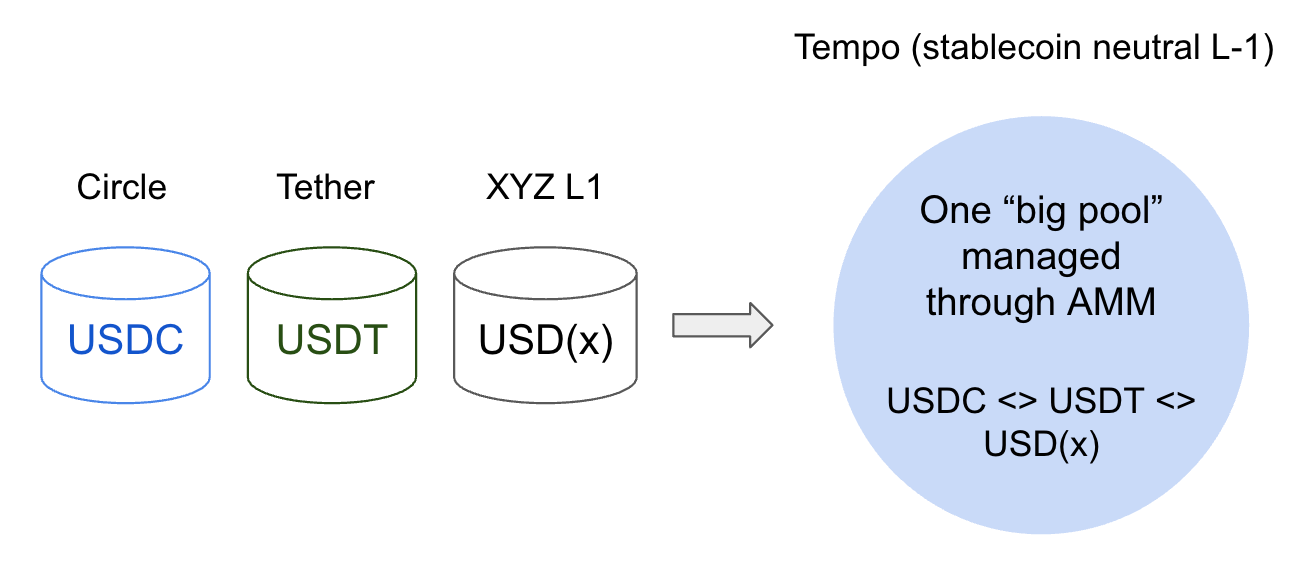

Stripe’s Tempo takes a different path by being stablecoin-neutral. This could appeal strongly to builders looking for flexibility and users who don’t care which USD tokens to use as it relies on its internal AMM to support various USD tokens.

Trends in L-1 Adoption

From my inference, there are three main trends:

Trend #1: TradFi Onboarding - Trust & Regulation

For stablecoin issuers, building their own L-1 is about winning trust. By controlling the rail or ecosystem, rather than relying solely on Ethereum, Solana or Tron. Circle and Tether can easily offer compliance-ready infrastructure that aligns with framework such as GENIUS Act (US) and MiCA (EU).

Circle has already positioned USDC as a regulated product by requiring Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance frameworks for entities overseeing USDC to USD redemptions. Arc, its newly announced Layer 1, goes a step further by combining auditable transparency with privacy features making it a credible candidate for institutional adoption. Tether, through its Stable and Plasma chains, is following a similar playbook. The goal is to become the infrastructure backbone for banks, brokers and asset managers.

Potentially, the “ideal“ use case here is FX trading. Using Circle’s Arc, with its sub-second finality, more than 1k transactions per second (TPS) and FX functionality. Arc could allow market makers, banks to settle foreign exchange (FX) transactions instantly. This creates an opportunity for them to tap into the $7+ trillion daily FX market, creating powerful network effects. Stablecoins like USDC and EURC could pioneer and become the native settlement assets, locking builders into its ecosystem firmly. This could also open the gateway to facilitate DeFi apps that supports institutional-grade RFQ (Request for Quotes) systems with the benefit of smart contracts reducing counterparty risks and ensuring quick settlement.

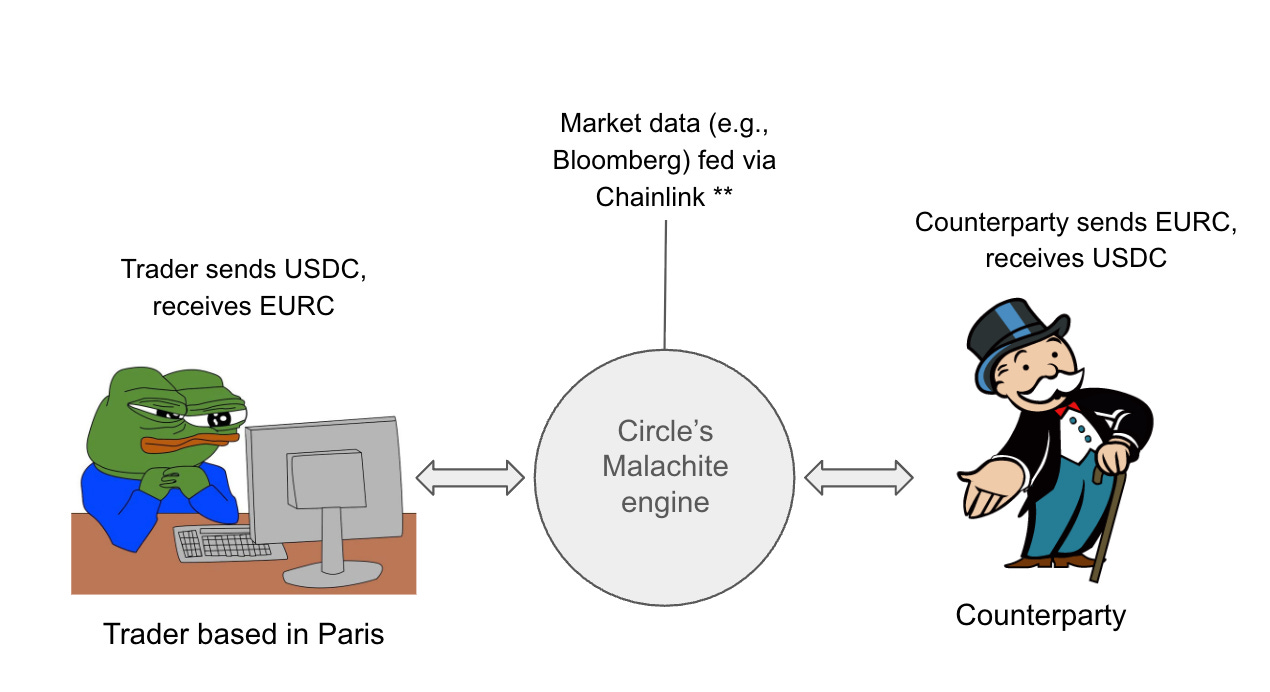

**This scenario assumes a Chainlink oracle for illustrative purposes.

Diagram illustrating the flow for trader transacting through Circle’s L-1

Consider a scenario where a Paris-based FX trader could swap $10 million USD to EUR via USDC/EURC pairs directly on Arc, with Malachite. I assume they could use a Chainlink oracle, to pull in real-time rates (e.g., 1 USD = 0.85 EUR) and executes a $10M USDC-to-EURC swap in <1 second, reducing traditional FX settlement delays from T+2 to T+0. Voila!

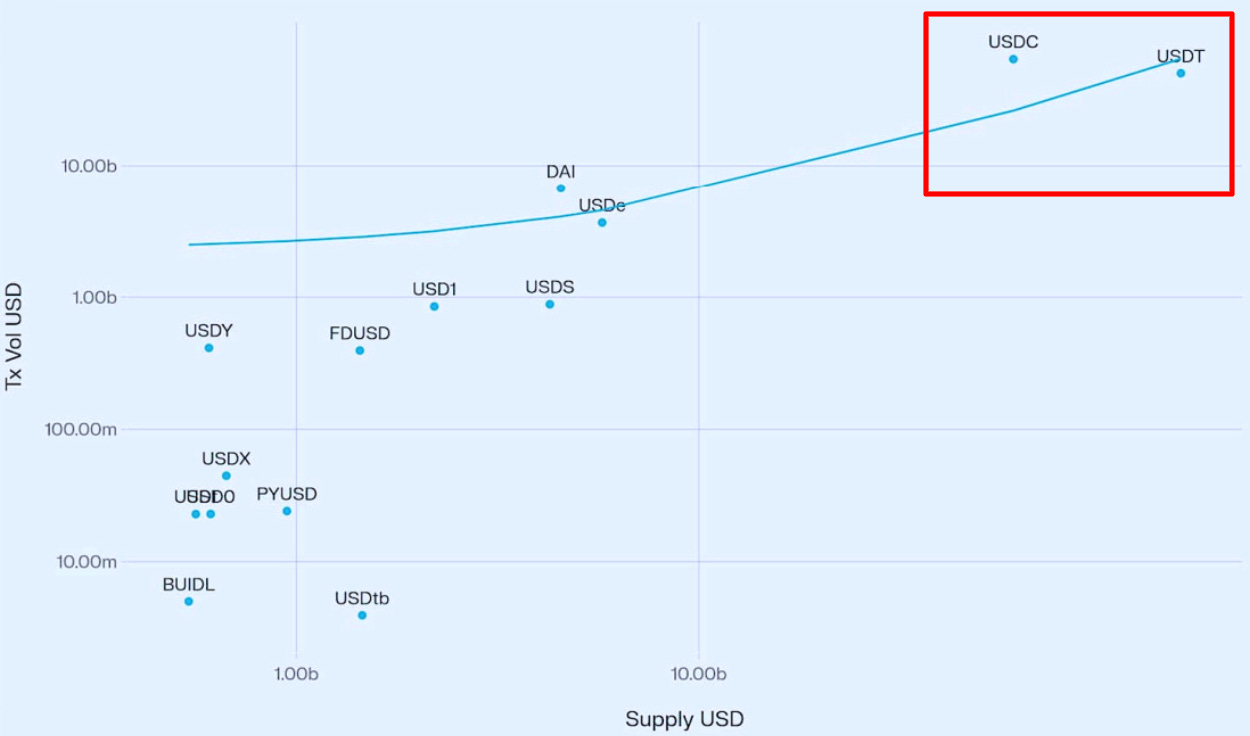

Source: Stablecoin Growth and Market Dynamics by Vedang Ratan Vatsa

Research supports this direction. Per Vedang Ratan Vatsa, there’s a strong positive correlation between stablecoin supply and transaction volume indicating larger supply translates into deeper liquidity and more adoption. Tether and Circle, as the two biggest issuers, hence they are primed to capture this institutional flow.

However, significant challenges hinder the integration of TradFi into blockchain rails. Coordinating across regulators, central banks and regional laws requires navigating a complex landscape (e.g; aligning with the various central banks, a process that can take years). Issuing stablecoins for diverse currencies (e.g., a proposed XYZ token for emerging market currencies) adds further complexity, with slow to zero adoption due to limited product-market fit in developing economies. Even if these hurdles can be overcome, banks and market makers may hesitate to shift mission-critical infrastructure to new rails. The transition could add additional costs, as not all currencies are available on-chain, forcing institutions to maintain both crypto and traditional systems. Moreover, with multiple issuers such as Circle, Tether, Stripe and potentially banks launching their own blockchains, the risk of siloed liquidity grows. Fragmentation could prevent any single rail from achieving the scale or liquidity needed to dominate the $7T daily FX market.

Trend #2 - Are stablecoin chains a threat to old guards of payment rails?

As L-1s court TradFi with their programmable nature, the rise could also disrupt legacy payment giants such as Mastercard, Visa and PayPal by offering instant, low-cost settlement across a broad suite of decentralised applications. Unlike closed, single-platform systems, these rails are open and programmable. These features provide developers and fintech firms with a flexible foundation to build, much like renting cloud computing infrastructure on AWS rather than hosting payment infrastructure on-premises servers. This shift can enable builders to deploy products for cross-border remittances, agentic (AI-driven) payments, and tokenised assets with near-zero fees and sub-second finality.

For instance, a developer could build a payment dApp on a stablecoin chain that settles instantly. Merchants and consumers benefit from fast and cheap transactions, while L-1s like Circle, Tether and Tempo capture value as indispensable infrastructure. The biggest difference is that these systems cut out the intermediaries like Visa and Mastercard, capturing more value directly for builders and users.

However, risks abound. As more issuers and payment firms launch their own Layer 1s, the ecosystem risks fragmentation. Merchants may face a tangle of “USD tokens“ from different chains but not easily interchangeable. Circle’s Cross-Chain Transfer Protocol (CCTP) is one attempt at solving this issue by creating a single liquid version of USDC across multiple chains but its reach is limited to Circle’s token. In an oligopolistic market, interoperability could become the key chokepoint.

The landscape has shifted further with Stripe’s recent announcement of Tempo, a stablecoin-neutral Layer 1 incubated with Paradigm. Unlike Circle and Tether, Stripe hasn’t launched its own token yet, instead Tempo supports multiple stablecoins for gas and payments via a built-in AMM. This neutrality could prove attractive to builders and merchants who want flexibility without getting locked-in, potentially giving Stripe a wedge into a space long dominated by crypto-native firms.

Trend #3 - Dupopoly Dynamics - Circle vs. Tether

As these L-1s challenge traditional players, they’re also reshaping the market structure. Currently, Circle and Tether dominate the stablecoin landscape by controlling nearly 89% of issuance as of September 2025, with Tether at 62.8% and Circle at 25.8%. By launching their own L-1s (Arc and Stable/Plasma), they reinforce dominance with high entry barriers. For example, Plasma raised $1 billion in vault deposits for its token sale cap creating a high barrier to entry. Market concentration, measured by the Herfindahl-Hirschman Index (HHI) at 4.6k (62.8² + 25.8² ≈ 4466), exceeds the 2,500 threshold, normally raising antitrust scrutiny in traditional markets.

Yet, a subtle threat emerges which is stablecoin-neutral L-1s. Stripe’s Tempo reduces onboarding friction for merchants and concentration risks for regulators. This flips incumbents’ closed moats into weaknesses, if neutrality becomes standard, Circle and Tether risk losing network effects and mindshare. Today’s duopoly may shift toward an oligopolistic structure, with multiple rails carving niches.

Conclusion

To conclude, with stablecoins now a $280 billion + powerhouse and issuers reaping massive benefits, the rise of stablecoin-backed L-1s illustrates three powerful trends: (1) onboarding traditional finance into crypto-native rails, tapping into the ever-growing FX market (2) transforming payments by removing middlemen such as Mastercard and Visa and (3) redefining market dynamics from a duopoly (HHI 4.6k) toward an oligopoly. Collectively these shifts point to a bigger vision: stablecoin issuers like Circle and Tether, alongside new entrants like Stripe’s Tempo, are no longer just a bridge between crypto and fiat but are positioning themselves as the foundation of tomorrow’s financial infrastructure.

Ultimately, this raises a question for my readers: How will these rails achieve product-market fit? Will Circle’s Arc, Tether’s Stable/Plasma or stablecoin-neutral challenger like Tempo lead the way, measured by transaction volume or institutional adoption? Despite opportunities and liquidity fragmentation, hurdles loom. Share your thoughts below!

References

[1] https://www.sciencedirect.com/science/article/pii/S0165176524004233#:~:text=The%20first%20stablecoin%20went%20live,blockchain%20and%20was%20crypto%2Dbacked.

[2] https://www.circle.com/blog/introducing-arc-an-open-layer-1-blockchain-purpose-built-for-stablecoin-finance

[3] https://tokenterminal.com/explorer/markets/stablecoin-issuers/metrics/outstanding-supply

[4] https://www.coindesk.com/policy/2025/07/18/tether-ceo-says-he-ll-comply-with-genius-to-come-to-u-s-circle-says-it-s-set-now

[5] Stablecoin Growth and Market Dynamics by Vedang Ratan Vatsa

[6] https://tempo.xyz/

[7] https://uk.finance.yahoo.com/quote/CRCL/financials/